Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

Terminal value is the estimated value of a business beyond the explicit forecast period. It is a critical part of the financial model, as it typically makes up a large percentage of the total value of a business. There are two approaches to the DCF terminal value formula: (1) perpetual growth, and (2) exit multiple.

When building a Discounted Cash Flow / DCF model, there are two major components: (1) the forecast period and (2) the terminal value.

The forecast period is typically 3-5 years for a normal business (but can be much longer in some types of businesses, such as oil and gas or mining) because this is a reasonable amount of time to make detailed assumptions. Anything beyond that becomes a real guessing game, which is where the terminal value comes in.

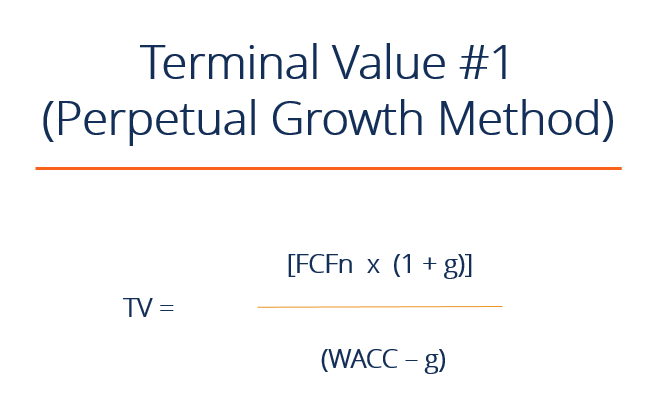

The perpetual growth method of calculating a terminal value formula is the preferred method among academics as it has a mathematical theory behind it. This method assumes the business will continue to generate Free Cash Flow (FCF) at a normalized state forever (perpetuity).

The formula for calculating the perpetual growth terminal value is:

TV = (FCFn x (1 + g)) / (WACC – g)

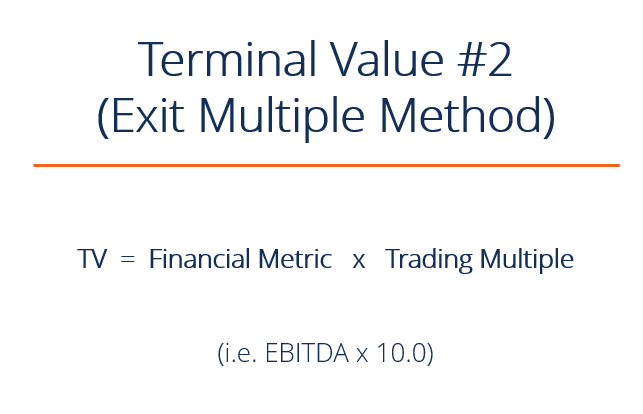

The exit multiple approach assumes the business is sold for a multiple of some metric (e.g., EBITDA) based on currently observed comparable trading multiples for similar businesses.

The formula for calculating the exit multiple terminal value is:

TV = Financial Metric (e.g., EBITDA) x Trading Multiple (e.g., 10x)

The exit multiple approach is more common among industry professionals, as they prefer to compare the value of a business to something they can observe in the market. You will hear more talk about the perpetual growth model among academics since it has more theory behind it. Some industry practitioners will take a hybrid approach and use an average of both.

Below is an example of a DCF Model with a terminal value formula that uses the Exit Multiple approach. The model assumes an 8.0x EV/EBITDA sale of the business that closes on 12/31/2022.

As you will notice, the terminal value represents a very large proportion of the total Free Cash Flow to the Firm (FCFF). In fact, it represents approximately three times as much cash flow as the forecast period. For this reason, DCF models are very sensitive to assumptions that are made about terminal value.

A common way to help represent this is through sensitivity analysis.

Enter your name and email in the form below and download the free template now!

Download the free Excel template now to advance your finance knowledge!

Below is a short video tutorial that explains how to calculate TV step by step in Excel. This example is taken from CFI’s financial modeling courses.

To learn more about valuation and financial modeling, check out these additional CFI resources:

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.